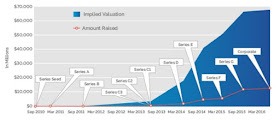

Jun, 2016 $3.5B / Private Equity — Saudi Arabia's Public Investment Fund 1

Feb, 2016 $200M / Private Equity — Letterone Holdings SA 1

Aug, 2015 $100M / Private Equity — Tata Capital 1

Jul, 2015 $1B / Series F — — 5

Feb, 2015 $1B / Series E — Glade Brook Capital Partners 9

Jan, 2015 $1.6B / Debt Financing — Goldman Sachs 1

Dec, 2014 $1.2B / Series E — Valuation at $40B Glade Brook Capital Partners 8

Jun, 2014 $1.4B / Series D — Valuation at $18.2B Fidelity Investments 9

Aug, 2013 $258M / Series C — Valuation at $3.5B GV 3

Dec, 2011 $37M / Series B — Menlo Ventures 12

Feb, 2011 $11M / Series A — Valuation at $60M Benchmark 6

Oct, 2010 $1.25M / Angel — First Round 29

Aug, 2009 $200k / Seed — Garrett Camp, Travis Kalanick 2

Uber IPO Value: What Was Uber Worth at Its IPO?

When Uber went public in May 2019, it was one of the most anticipated IPOs of the decade. The ride-hailing giant had already transformed urban transportation across the globe, but its valuation and market performance became the center of attention. Understanding Uber’s IPO value helps investors, analysts, and everyday riders see how the company grew and where it stands today.

Uber’s IPO Launch

Uber priced its shares at $45.00 during its initial public offering on May 10, 2019. The company issued 180 million shares on the New York Stock Exchange under the ticker symbol UBER. This pricing came in at the lower end of its expected range, signaling cautious optimism from investors.

Uber’s Valuation at IPO

The IPO gave Uber a market capitalization of about $75.5 billion based on the number of shares offered. On a fully diluted basis, which accounts for restricted stock units and other employee incentives, its valuation was closer to $82 billion. This made Uber one of the largest IPOs in U.S. history.

IPO Value Table

| Metric | Value |

|---|---|

| IPO Share Price | $45.00 |

| Shares Issued | 180 million |

| Market Cap (Basic) | ~$75.5 billion |

| Market Cap (Fully Diluted) | ~$82 billion |

Why Uber’s IPO Value Mattered

Uber’s IPO was more than just a financial milestone. It tested the appetite for high-growth but money-losing tech companies. At the time, Uber was still reporting billions in annual losses, yet its massive market share and global reach kept investor interest alive. The company’s valuation set the tone for other ride-sharing and gig economy startups considering public offerings.

Performance Since 2019

Since going public, Uber’s stock has seen ups and downs. Initially, it struggled as investors questioned its path to profitability. However, growth in Uber Eats, expansion into freight, and post-pandemic demand recovery have pushed shares higher. As of September 2025, Uber trades around $92.95 per share, giving it a market cap well over $150 billion based on outstanding shares. This shows how the company has nearly doubled in value since its IPO.

Comparison With Other Tech IPOs

Uber’s IPO ranks among the largest tech offerings, comparable to Facebook’s 2012 IPO and Alibaba’s record-breaking 2014 IPO. Its value also exceeded its rival Lyft, which debuted earlier in 2019 with a valuation of about $24 billion. Uber’s scale and international presence gave it a significant edge, even though both companies face similar regulatory and profitability challenges.

Key Takeaways

-

Uber IPO share price was $45.00 in May 2019.

-

Initial market cap was about $75.5 billion ($82 billion fully diluted).

-

Today, Uber’s market value has grown to more than $150 billion.

-

The IPO marked a major milestone for the gig economy and ride-sharing industry.

For investors, Uber’s IPO highlighted the risks and rewards of betting on disruptive tech companies. While its early years as a public company tested investor patience, Uber’s long-term growth has rewarded those who held on.

Further Reading

You can explore Uber’s official investor relations page at investor.uber.com and filings with the U.S. Securities and Exchange Commission for detailed updates.